Budgeting Tool for Students

Simplifying personal finance and money management for young adults gaining financial independence.

Overview

From personal experience, I noticed that college students often struggle with money management and lack financial confidence.

For my class project, I set out to understand the challenges students face and design a solution that simplifies money management

My Role

Lead Product Designer

Timeline

Aug - Dec 2020, 4 months

Technology

Adobe XD

Miro

1. Problem

Pain Points

Starting off, I met with students in the class to understand their financial goals and frustrations. I identified the following themes.

Lack of Education

Schools lack personal finance courses, leaving students poorly prepared to manage their money.

App Complexity

Existing budgeting apps and features can be overwhelming for students just starting to manage their finances.

Spending Habits

Students want to build good financial habits but feel overwhelmed and unsure where to start.

Design Goal

How might we design a simple, effective money management tool that helps those new to personal finance gain confidence, build good habits, and take control of their financial future?

1. Problem

The Context

The Challenge

2. Research

User Research

Competitive Analysis

3. Concept

Feature Scoping

Information Architecture

Low-Fidelity Prototype

4. Visual Design

Usability Testing

Design Refinements

High-Fidelity Prototype

2. Research

Competitive Analysis

To guide my direction, I conducted secondary research on leading money management services, analyzing their features and functionality.

This identified what's most effective and established a foundation for my concept's needs.

Feature Proposals

Based on my research, I developed a concept focused on simplicity and effectiveness.

My goal was to ensure that users, especially those new to personal finance, could easily understand information about their money.

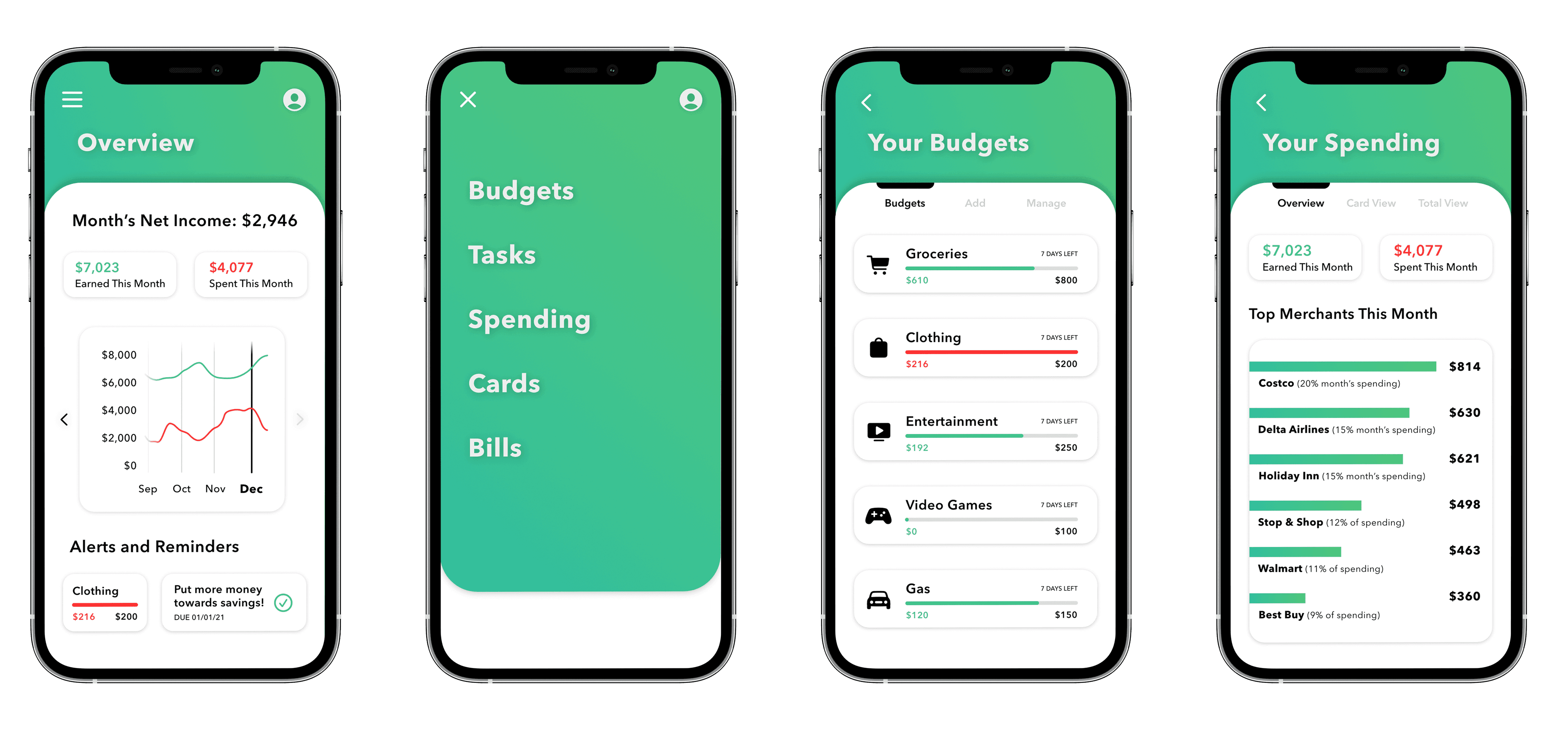

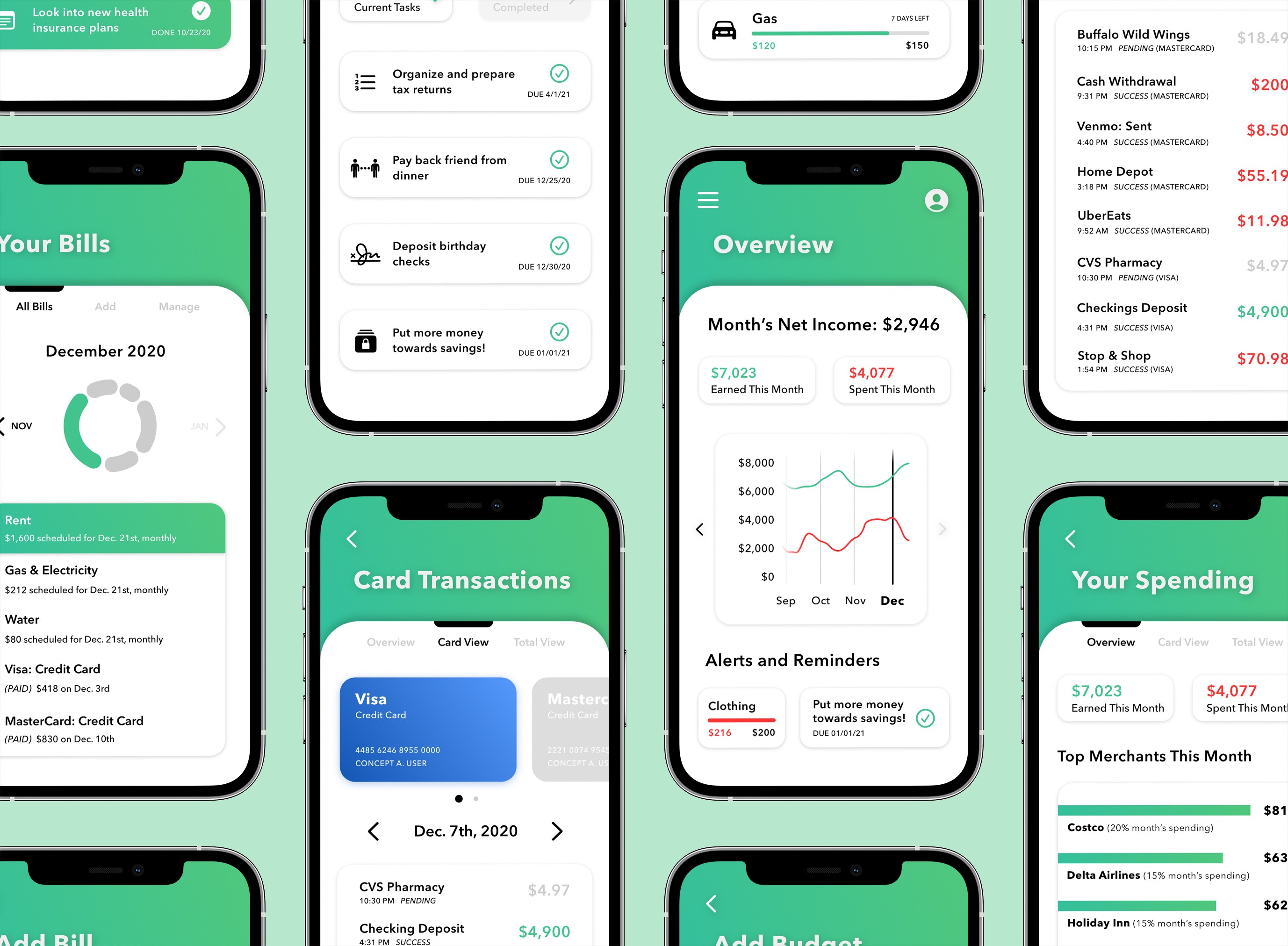

Budgets

Set spending limits for specific categories and customize budget durations.

Spending

Track cash flow, monitor spending trends, and identify top merchants.

Recurring Bills

Automatically detect recurring payments, track due dates, and receive notifications for upcoming or increased charges.

3. Conceptualization

Low-Fidelity Design

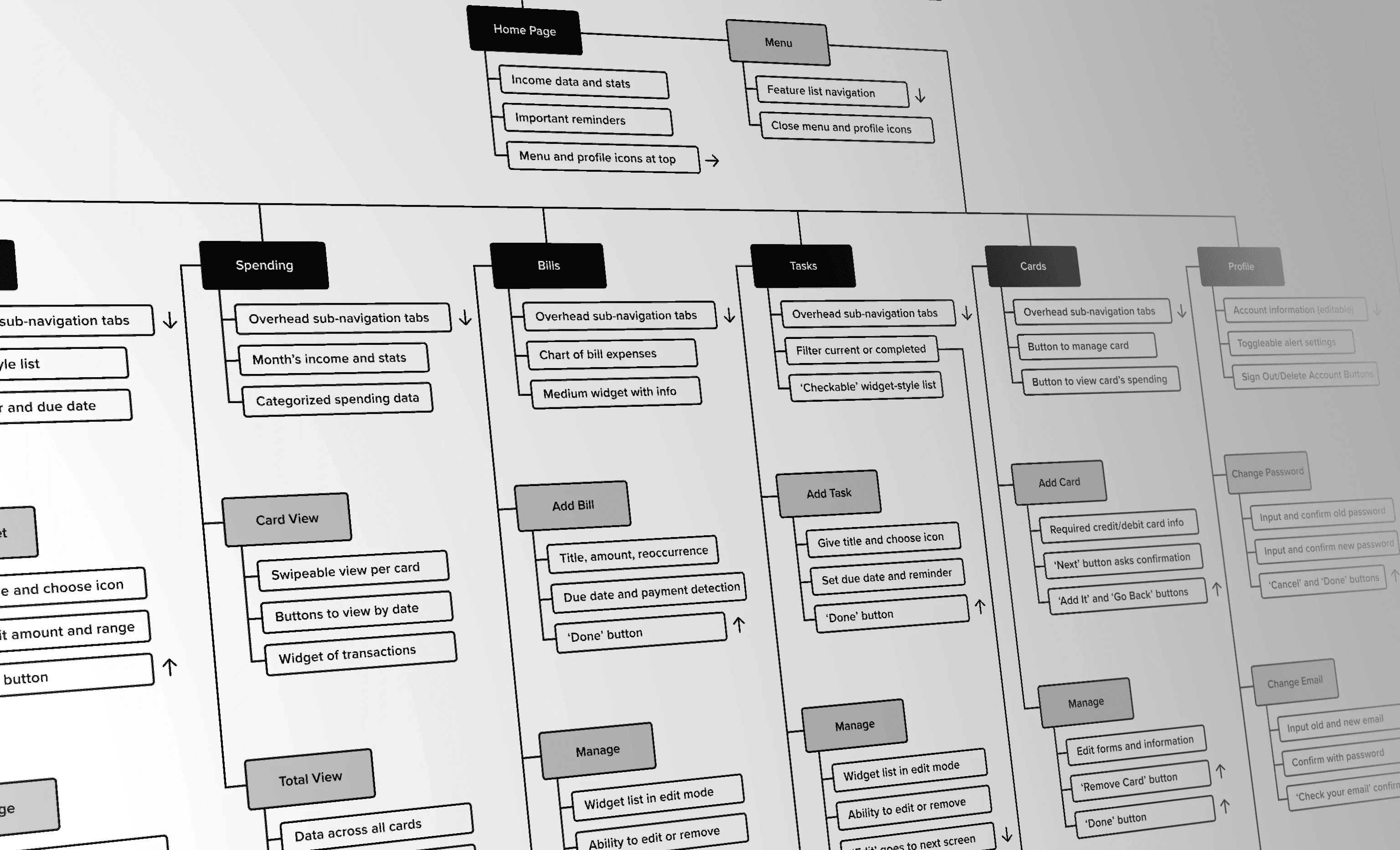

After defining key features, I mapped out an information architecture diagram to visualize screens and navigation.

From there, I designed wireframes to create a basic prototype.

4. Visual Design

Testing It Out

I conducted moderated usability sessions, observing how students navigated the prototype and completed tasks.

Overall feedback was positive, but some students experienced confusion, which helped guide refinements in my high-fidelity design noted below.

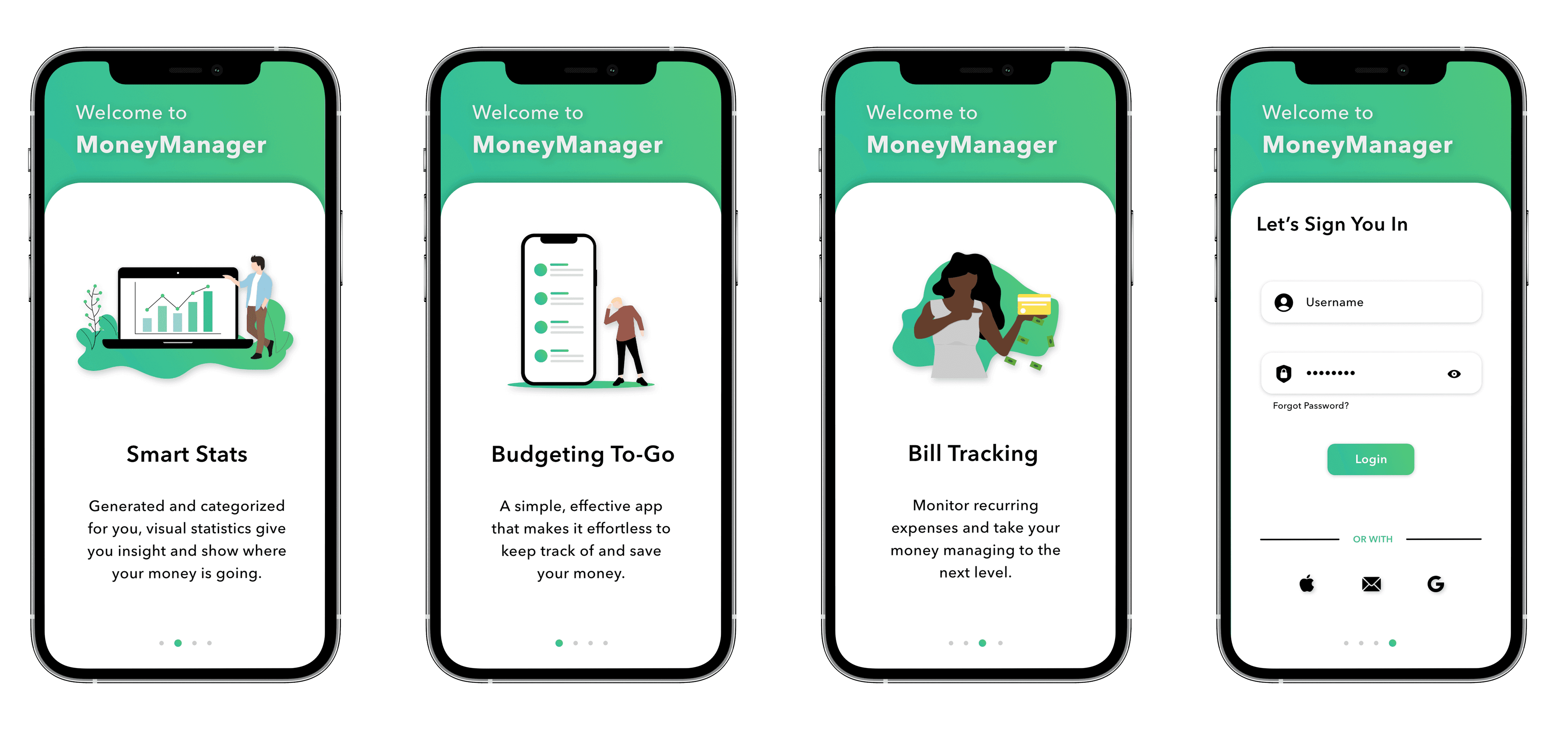

The Onboarding

Feedback

Users expressed confusion on the sign-in page about my concept's purpose and why they should use it over other services.

Solution

I implemented an onboarding flow before the sign-in page to provide users with a clear understanding of the features and benefits.

A/B Testing Navigation

Feedback

Testing both a bottom navigation bar and a drop-down menu revealed a preference for the latter.

Solution